richmond property tax inquiry

Be Your Own Detective. Welcome to the My Property Account online access for the City of Richmond.

Please feel free to call us at 281-341-3710 or email us at FBCTaxInfofortbendcountytxgov with any.

. Real Estate Property Tax - Jackson County Mo. Phone Email Social Marriage Status More. Pay Your Parking Violation.

Ad Find Info On People. Penticton Property Tax 2021 Calculator Rates Wowaca. Vagas Jackson Tax Administrator 1401 Fayetteville Rd.

My Property Account is an online profile that gives you secure access to information regarding your City of. 804 646-5686 1999-2022 City of Richmond Virginia. Then Search Phone Address Full Public Records Data Fast.

For information and inquiries regarding amounts levied by other taxing authorities please contact them directly at. Enter Any Name City Or State. For all who owned property on January 1 even if the property has been sold a tax bill will still be.

Manage Your Tax Account. Richmond City Assessors Office 900 E. To search for tax information you may search by the 10 digit parcel number last name of property owner or site address.

Property Taxes Due 2021 property tax bills were due as of November 15 2021. City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as.

Click Here to Pay. Property Tax Vehicle Real Estate Tax. Parking tickets can now be paid online.

Call 804 646-7000 or send an email to the Department of Finance. Rockingham NC 28379 Business. Welcome to the Augusta-Richmond County BOA Office Website.

The results of a successful search will provide the user with. Understanding Your Tax Bill. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established.

City of Richmond Real Estate Search Program. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp. The City Assessor determines the FMV of over 70000 real property parcels each year.

Property value 100000. Broad St Rm 802 Richmond VA 23219 Phone. The Tax Commissioner is an elected Constitutional Officer.

Use the search tab to add properties to your selection list. By Richmond City Council. 804 646-7500 Fax.

In Person at City Hall. Other Services Adopt a pet. Tangible personal property is the.

Online Credit Card Payment Service Fees Apply Pay property taxes and utilities by credit card through the Citys website. Parking Violations Online Payment. Due Dates and Penalties for Property Tax.

City of richmond property tax inquiry. To pay your 2019 or newer property taxes online visit. Finance Taxes Budgets.

The mission of the Richmond County Board of Assessors Office is to provide and defend uniform fair market values on all. Visa MasterCard and American Express. This utility allows a person to interactively search the City of Richmond real property database on criteria such as Parcel ID Address Land Value Consideration Amount etc.

1808 Bath St Richmond Va 23220 Zillow

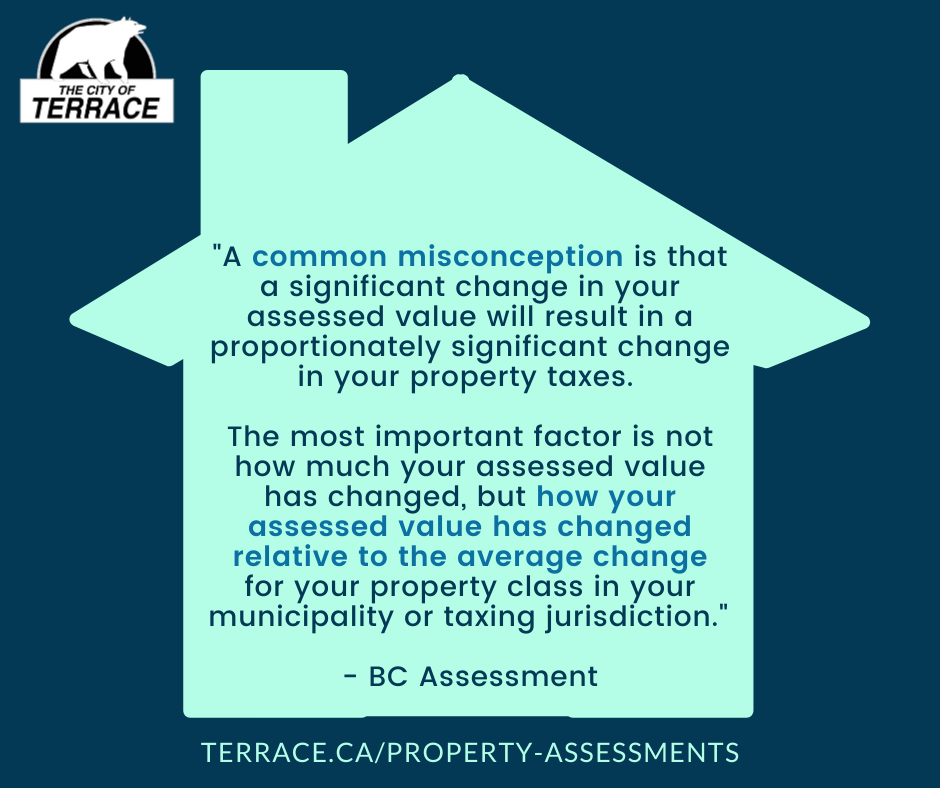

Property Assessments City Of Terrace

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Property Assessments City Of Mission

Municipal Property Assessment Mpac City Of Richmond Hill

About Your Tax Bill City Of Richmond Hill

About Your Tax Bill City Of Richmond Hill

My City At Work City Of Richmond Hill

Tax Assessor Collector Fort Bend County

Mayor And Council City Of Richmond Hill

Ontario Cities With The Highest Lowest Property Tax Rates October 2022 Nesto Ca

About Your Tax Bill City Of Richmond Hill